To calculate the employees ordinary hourly rate of pay youll first need to calculate their ordinary rate of pay daily. Bonus - Non-fixed remuneration which is paid on a quarterly or yearly basis.

Your Step By Step Correct Guide To Calculating Overtime Pay

Heshe will have an ordinary rate of pay of RM100 RM2600 26 RM100.

. Ordinary Rate of Pay OPR. The Employment Act came into force effective 1 June 1957 which applies only to West Malaysia. This is applicable whether the employees are paid on a daily rate or on a monthly basis.

The ordinary rate of pay on a monthly basis shall be calculated according to the following formula. It is not based on the number of working days in the month. Malaysias minimum wages policy is decided under the National Wages Consultative Council Act 2011 Act 732.

In addition they earn an average bonus of RM1282. Hourly rate of pay - the ordinary rate of pay divided by the normal hours of work. Employees who earn monthly wages of RM2000 or less.

This involves using a standardised 26-day ruling for calculation of a Regular Day rate of pay per month for an employee. Every employee shall be entitled to 11 paid holidays at his ordinary rate of pay on the following days in any 1 calendar year 5 of which shall be. So when an employee works 8 hours a day for a monthly salary of RM2600 heshe will have an ordinary rate of pay of RM100 Monthly salary 26 RM2600 26 RM100.

How to calculate per day salary malaysia ordinary rate of pay in this context is basically the employees daily wage and is calculated by dividing the. There is a tripartite body known as the National Wages Consultative Council which is formed. When an employee receives a monthly rate of pay the ordinary rate of pay should calculate accordingly.

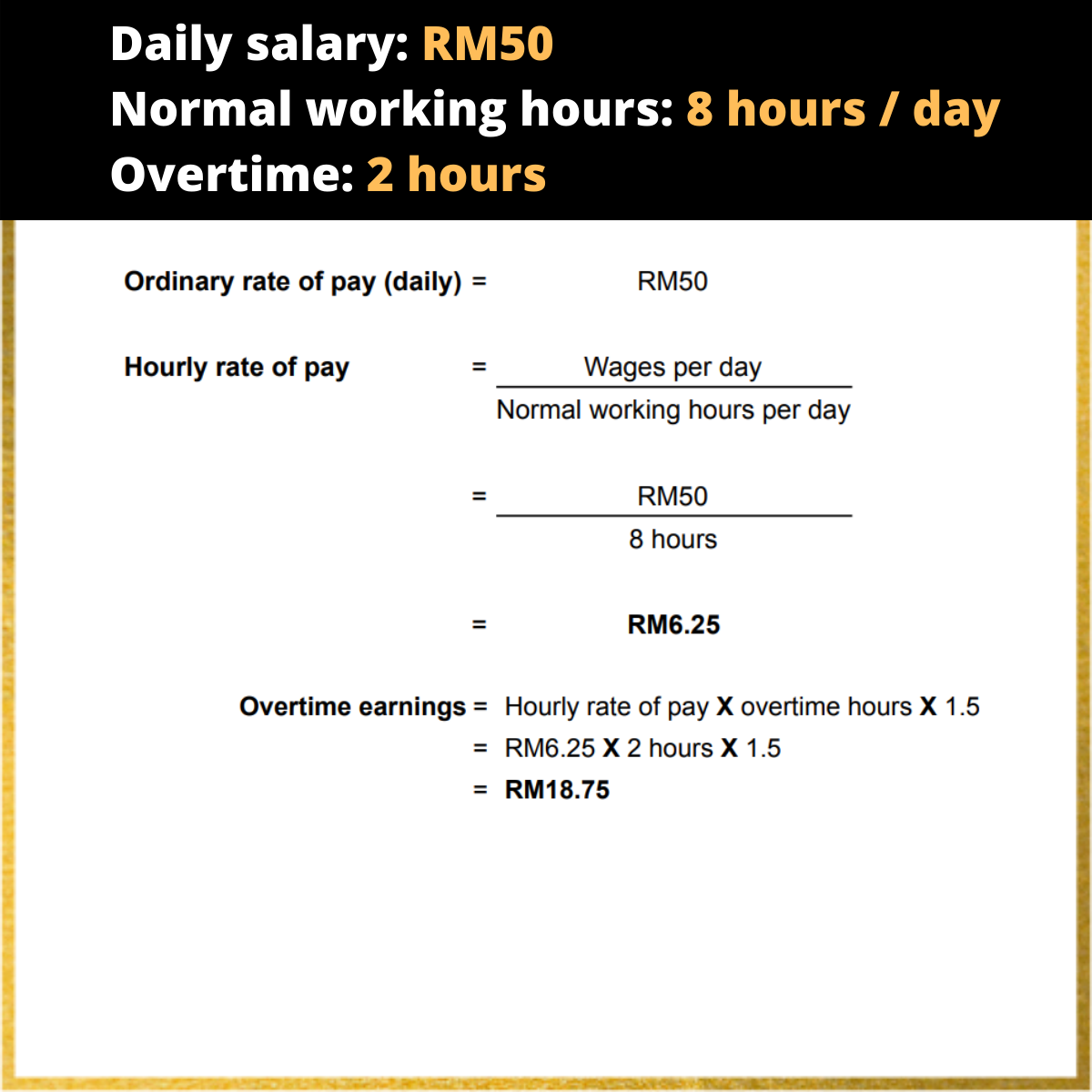

In the case of an employee employed on piece rates who works on a rest day shall be paid 2 times the ordinary rate per piece. 22 2022 at 741 PM PDT Updated. How to calculate Ordinary Rate of Pay and Hourly Rate of Pay.

Her hourly rate of pay is her ordinary rate of pay divided by her normal hours of work per day. Then divide the ordinary rate by the number of normal work. PART I - PRELIMINARY.

Annual Salary After Tax Calculator. Monthly rate of pay26 days Section 60I 1A EA. Select a tax calculator from the list below that matches how you get paid or how your salary package is detailed.

The average ordinary seaman gross salary in Malaysia is RM55250 or an equivalent hourly rate of RM27. Malaysia has a standard way of calculating daily rate of pay - titled the Ordinary Rate of Pay ORP. For example an employee who works 8 hours a day for a monthly salary of RM260000.

Shall be entitled to receive from the employer for each day of the eligible period a maternity allowance at her ordinary rate of pay for one day or at the rate prescribed by the Minister under. An entry level ordinary seaman 1-3 years of experience earns an average. For normal working days an employee should be paid at a rate of 15 times their hourly rate for overtime work.

The calculations is base on the number of days in a month. Paying employee wages late. Of work days in the relevant month.

To do this divide the monthly salary by 26 days. Effective 1 November 2000 it also applies to the Federal Territory of Labuan. Short title and application.

However the Act only covers a number of select employee categories in Malaysia. The Ordinary Rate is an employees daily rate that is calculated based on Salary 26. The monthly wage calculator is updated with the latest income tax rates in malaysia for 2022 and is a great calculator for working out your.

Section 2 1 defined wages as means basic wages and all other payments in cash payable to an employee for work done in respect of his contract of service but does not include. Monthly rate of pay No. Then take the daily rate and divide that figure by the number of hours to get the employees hourly rate.

Section 60E 1 from the Employment Act 1955 states An employee is entitled to a certain number of paid annual leave days in addition to rest days and paid holidays. The same employees. The calculation formula for your ordinary rate of pay per day is your monthly salary divided by 26 days which is fixed and then the amount divided by 8 hours to get your.

The employer can use any other formula as he wished as long as the answer he gets is more favourable to the employee than the above answer. Daily rate of pay for a monthly-rated employee is calculated using the formula below. According to the Employment Act 1955 employers are required to payout monthly wages on the seventh day of the following month or earlier.

In Malaysia incentives are performance-based payments and include. HONOLULU HawaiiNewsNow - A Kapolei couple accused of stealing the identities of dead kids failed in their second bid to get bail. First calculate the daily ordinary rate of pay by dividing the monthly salary by 26.

Salary for January 2016 RM 1000 x 20 31 RM 64516. An hourly rate of pay of RM1875 1508. RM6923 8 hours RM865.

Section 60F 3 of the Employment Act 1955 states The employer shall pay the employee his ordinary rate of pay for every day of such sick leave and an. 60 of Malaysia Employment Act 1955. But the additional suspicion that theyre Russian spies was not a factor in Mondays ruling.

The main legislation relates to minimum wages in Malaysia are National Wages Consultative Council Act 2011 Act 732 Minimum Wages Order 2020. Salary estimates based on salary survey data collected directly from employers and anonymous employees in Malaysia. District Court Judge Leslie.

Calculate your income tax in Malaysia salary deductions in Malaysia and compare salary after tax for income earned in Malaysia in the 2022 tax year using the Malaysia salary after tax calculators. RM1800 RM26 RM6923. For example an employee whose monthly salary is RM3900 and is required under her employment contract to work 8 hours a day has an ordinary rate of pay of RM150 390026.

Your Step By Step Correct Guide To Calculating Overtime Pay

Your Step By Step Correct Guide To Calculating Overtime Pay

Your Step By Step Correct Guide To Calculating Overtime Pay

How To Calculate Overtime Pay For Employees In Malaysia Althr Blog

0 Comments